Learn how to claim your second stimulus check of $670 per adult and $680 per child. Get step-by-step advice, helpful FAQs, and see detailed payment info in our easy-reference table.

Understanding Your Second Stimulus Payment

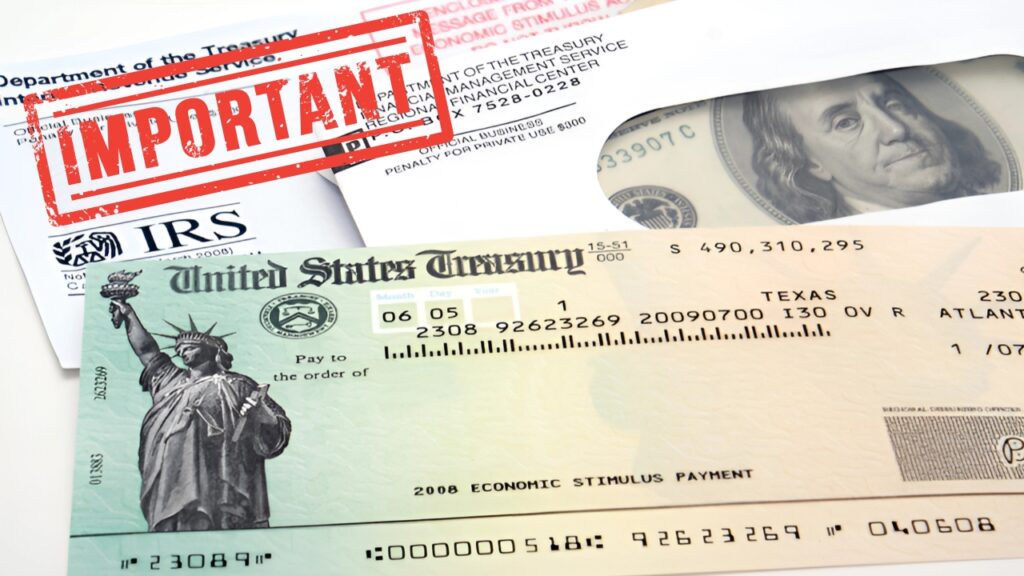

Many Americans counted on the second stimulus payment (also known as the Economic Impact Payment or EIP) during the COVID-19 pandemic. If you haven’t received yours or are unsure what to do next, this guide is for you. Let’s break down what you need to know and steps you can take.

What Was the Second Stimulus Payment?

The government issued a second round of direct support at the end of December .

Most adults were entitled to $680 while each child under 17 also qualified for an extra $670. The payment aimed to offer immediate financial relief in tough times.

Who Got the Payment?

Most people: If you received the first stimulus payment, you likely qualified for the second as well.

Delivered via: Direct deposit, mailed check, or prepaid debit card.

How Do I Know If I Got My Payment?

Usually, the payment came by the same method as your first one:

Direct Deposit: Check your bank statement for a deposit from the U.S. Treasury.

Mailed Check: Look out for an envelope with the U.S. Department of Treasury seal.

EIP Debit Card: These arrive in a mostly white envelope. Don’t throw this away— it’s not a scam!

When and How Were Payments Sent?

All payments for this round were sent

If you opted for mail and hadn’t received anything after four weeks, you were advised to take further action.

What If You Didn’t Receive Your Second Stimulus Payment?

1. Check Your Mail Carefully

Sometimes payments got delayed, especially if sent by mail. It could take up to 4 weeks to arrive. Always inspect any envelopes from the U.S. Treasury before discarding.

2. Still Nothing? File Your Taxes

If you did not receive your stimulus payment by February 12, 2021, the best course of action was to file your 2020 federal tax return. Claim the Recovery Rebate credit, even if you don’t usually file taxes or have zero income.

Don’t Worry! Free Help Is Available

Many nonprofits and tax services offer free filing assistance.

Residents of Pennsylvania could use the Campaign for Working Families for help.

Outside PA? The IRS Volunteer Income Tax Assistance (VITA) program helps those who qualify.

Second Stimulus Payment Scheme – At a Glance

| Category | Amount Received |

|---|---|

| Adult | $670 per person |

| Child (under 17) | $680 per qualifying child |

FAQs

Q1: What should I do if my payment never came?

A: File your 2020 tax return and claim the Recovery Rebate credit, even if you don’t regularly file.

Q2: Can I get help with my taxes for free?

A: Yes, check for VITA clinics locally or the Campaign for Working Families in PA.

Q3: How will I know if my payment was sent?

A: The IRS sent it by the same method as your first payment—bank deposit, check, or debit card.

Stimulus Checks in August 2025: Which States Are Issuing Payouts and Who Qualifies?