Get updated Canada Carbon Rebate payment dates for 2025, amounts by province, and eligibility details. Tax-free quarterly payments start April 15.

If you’re wondering when your next Canada Carbon Rebate payment will arrive, you’re not alone. Rising fuel costs have made this government support more important than ever for Canadian families. This comprehensive guide breaks down everything you need to know about 2025 payment dates, amounts, and how this program can help offset your carbon pricing costs.

Understanding the Canada Carbon Rebate Program

The Canada Carbon Rebate (CCR) is the federal government’s way of returning carbon pricing revenue directly to eligible Canadians. Think of it as getting back the money you’ve paid through federal fuel charges throughout the year. This tax-free benefit helps families manage the financial impact of carbon pricing while supporting Canada’s transition to cleaner energy.

The program operates in provinces where the federal carbon pricing system applies, including Ontario, Alberta, Saskatchewan, Manitoba, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador. If you live in one of these provinces and have filed your tax return, you’re likely eligible to receive these payments.

2025 Payment Schedule and Important Dates

Quarterly Payment Timeline

Your Canada Carbon Rebate payments arrive four times per year on these specific dates:

- April 15, 2025

- July 15, 2025

- October 15, 2025

- January 15, 2026

If any payment date falls on a weekend or statutory holiday, the Canada Revenue Agency will issue your payment on the last business day before the 15th. All payments are deposited directly into your bank account if you have direct deposit set up, or mailed as a cheque to your address on file.

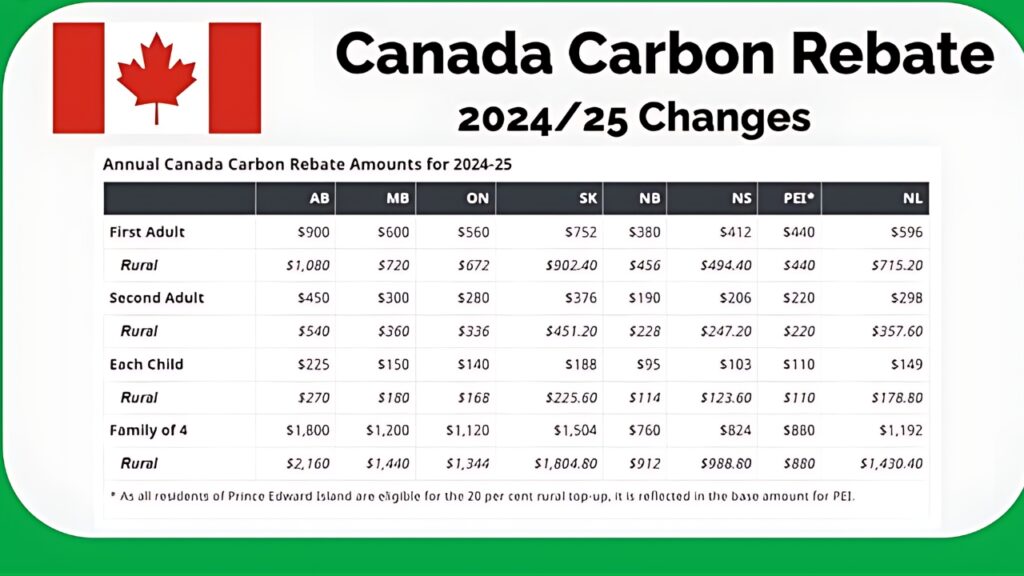

How Much Will You Receive?

The amount you receive depends on three key factors: your family size, which province you live in, and whether you qualify for the rural supplement. The government calculates these amounts to ensure families receive meaningful support while the carbon pricing system encourages cleaner energy choices.

Province-by-Province Payment Breakdown

| Province | Annual Rebate Amount | Quarterly Payment |

|---|---|---|

| Alberta | $1,544 | $386 |

| Saskatchewan | $1,360 | $340 |

| Ontario | $1,120 | $280 |

| New Brunswick | $1,136 | $284 |

| Nova Scotia | $1,312 | $328 |

| Manitoba | $1,056 | $264 |

| Prince Edward Island | $960 | $240 |

| Newfoundland & Labrador | $1,168 | $292 |

Note: These amounts are for the first adult in a household. Additional family members receive 50% of the base amount.

Rural Bonus: Extra Support for Rural Communities

Increased Rural Support in 2025

Rural Canadians face unique challenges when it comes to energy costs and transportation options. Recognizing this, the government has increased the rural supplement from 10% to 20% in 2025. This means rural residents receive significantly more support to help cover their energy expenses.

If you live in a rural or small community, your Canada Carbon Rebate payments will be 20% higher than the base provincial amounts. This rural designation is determined automatically based on your postal code, so you don’t need to apply separately for this bonus.

Eligibility Requirements Made Simple

Getting your Canada Carbon Rebate is straightforward if you meet these basic requirements:

Age and Residency: You must be 18 years or older and a Canadian resident for tax purposes. If you’re married or in a common-law relationship, only one spouse needs to apply, and both will be covered.

Tax Filing: You must file your annual tax return, even if you don’t owe any taxes. The Canada Revenue Agency uses your tax information to determine your eligibility and calculate your payment amount.

Provincial Eligibility: You must live in a province where the federal carbon pricing system applies. Quebec and British Columbia have their own carbon pricing systems and separate rebate programs.

Family Payment Structure

The Canada Carbon Rebate recognizes that larger families face higher carbon pricing costs. Here’s how payments work for different family situations:

First Adult: Receives the full provincial base amount

Spouse or Common-Law Partner: Receives 50% of the base amount

Each Child Under 19: Receives 50% of the base amount

Single Parents: Receive an additional 50% of the base amount for the first child

This structure ensures that families with children receive substantially more support, helping offset the higher energy and transportation costs that come with raising a family.

What’s New in 2025

Several important changes took effect in 2025 that directly benefit Canadian families:

The rural supplement increase from 10% to 20% represents the most significant change, providing hundreds of dollars in additional support for rural residents. The government has also streamlined the payment process, with most eligible Canadians now receiving payments automatically without needing to apply.

Additionally, the Canada Revenue Agency has improved its online tools, making it easier to track your payments and update your banking information for direct deposit.

Maximizing Your Benefits

To ensure you receive your full Canada Carbon Rebate entitlement, keep your information current with the Canada Revenue Agency. This includes your address, banking details for direct deposit, and family status changes like marriage, divorce, or new children.

If you move between provinces, notify the CRA immediately, as your rebate amount will change based on your new province’s carbon pricing level. Similarly, if you move from an urban to rural area (or vice versa), this will affect your rural supplement eligibility.

Frequently Asked Questions

Q: What if I haven’t received my payment?

A: Check your CRA My Account online or call 1-800-387-1193. Payments may be delayed if your banking information needs updating.

Q: Do I need to report these payments on my tax return?

A: No, Canada Carbon Rebate payments are tax-free and don’t need to be reported as income.

Q: Can I receive payments if I live in Quebec or BC?

A: These provinces have separate carbon pricing systems with their own rebate programs managed provincially.

2025 VA Disability Pay: $4,644.27 + $347.97 Added – See If You Qualify & Payment Dates